crypto tax accountant australia

Passionately work every day on every project to reduce tax as much as legally possible - keeping your hard earned wealth in your pocket. Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800.

Crypto Tax In Australia The Definitive 2021 2022 Guide

Over 15 years of practice and thousands.

. Crypto Tax Australia are happy to discuss these items with you so please drop us an email and we will be in contact. Partnered with the largest tax preparation platform to make it easy for you to E-File your crypto gains and losses with your full tax return. Our cryptocurrency tax consultants work closely with each of our clients whether individuals or organisations to find the best solutions for your circumstances.

Trusted By Aussie Accountants. Get in Touch T. 0325 5000 1625.

The tax rate on this particular bracket is 325. In Australia the amount of Capital Gains Tax owed on crypto depends on how long youve held your assets and your Income Tax bracket. Now with years of experience in both crypto investing and its tax implications.

49 per tax season. Janes estimated capital gains tax on her crypto asset sale is 1625. If you are an accountant please contact us to learn more about our accountant portal and corporate pricing.

Check out this directory of tax professionals. Suite 2641 Barratt Street Hurstville NSW 2220 Australia. Cryptocurrency Tax Accountants Advisors Crypto Tax Australia provides tailored and proactive Cryptocurrency Taxation advice to its clients whether you are an investor or trader anywhere.

However if your total income is less than 18200 a year you wont pay any Income or Capital Gains Tax. Specialist in tax advice for crypto traders capital gains record keeping. Opening Hours Monday Friday.

We are Australias GO-TO Cryptocurrency Tax Accountants and it will be our pleasure for you to use our service and benefit from our unique systems and knowledge. We are one of the few accountants on the Gold Coast that offer specific cryptocurrency solutions and support so if you are involved in crypto-trading it is important to work with an accountant who has knowledge in this field. Solves Crypto Tax Specialist is a Chartered Accountant with 12 years experience in Big 4 tax consulting who advises crypto investors traders and businesses using Koinly.

Do you need help from a professional with filing your crypto taxes. Crypto Tax Plus provides online personalised accurate and practical crypto related tax services to investors trader and enthusiasts alike. Look no further see our comprehensive list below of certified tax professionals including CPAs crypto accountants and attorneys that work with bitcoin and crypto taxation.

As an accountant whether you see crypto clients on a regular basis or once in a blue moon Crypto Tax Calculator Australia is here for all your crypto tax needs. Cryptocurrency tax returns generally start from 2500. Our platform is trusted by industry leading Australian accountants who value detailed and accurate reports.

Sign up for our free trial get a feel for the application then send us an email to get started in calculating your clients. Are you in need of a tax professional who specializes in bitcoin and cryptocurrencies. Crypto Accountants Tax Attorneys Enrolled Agents and Financial.

Friendly and personalised accounting services for individuals and businesses. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. 03 8609 1269 E.

We specialise in all types of crypto from the large market cap currencies BTC ETH XRP right through to the lesser known altcoins. Submit the afore-mentioned information today to obtain your tailored quote. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes.

Valles cryptocurrency tax accountants in Australia are found in Sydney Melbourne and Brisbane. We have two simple goals at Munros. There are no specific allowances for Capital Gains Tax in Australia.

Locate the best Bitcoin and crypto accountants tax preparation services enrolled agents and cryptocurrency tax attorneys near you. Tax return over the phone email is also available for all crypto traders and investors. Cryptocurrency tax reports are our specialty and best of all.

The official Crypto Tax Accountant directory. Crypto Tax in Australia - The Definitive 20212022 Guide. 08 9427 5200 Contact Us Now.

Crypto Tax Calculator Australia is here to help. Help demystify cryptocurrency taxation in Australia so you can make more informed decisions. Extensive knowledge of tax implication on all cryptocurrencies.

If you are not eager for an audit from the ATO or potentially penalties then Accounting Tax Solutions can help. Download your completed IRS forms to file yourself send to your accountant or import into software like TurboTax and TaxAct.

Cryptocurrency Tax Accountant Inspire Ca

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

7 Best Crypto Tax Software For 2022 Get The Biggest Tax Breaks

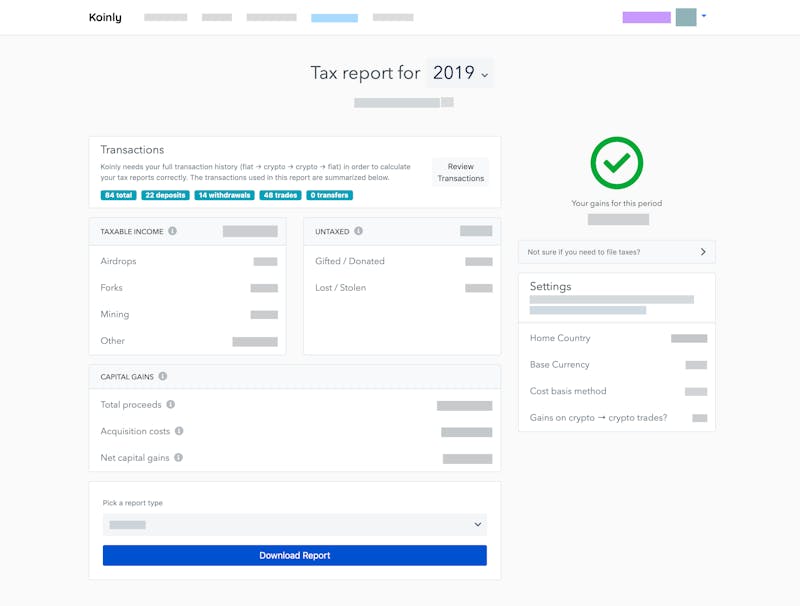

Cryptocurrency Tax Guides Help Koinly

Best Crypto Tax Software To Use For 2022 Tax Season

12 Best Crypto Tax Software In 2022 Free And Paid Options

Cryptocurrency Tax Australia 2021 Update Youtube

Cryptocurrency Tax Guides Help Koinly

5 Best Crypto Tax Software Accounting Calculators 2022

Cryptocurrency Tax Reports In Minutes Koinly

5 Best Crypto Tax Software Accounting Calculators 2022

Calculate Your Crypto Taxes With Ease Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Australian Tax Office Report Crypto Profits Or Else Internal Revenue Service Hr Block Investing In Cryptocurrency